Experience Modification Rate numbers (EMR) have a strong impact upon a business. It is a number used by insurance companies to gauge both past cost of injuries and future chances of risk. The lower the EMR of your business, the lower your worker compensation insurance premiums will be. An EMR of 1.0 is considered the industry average. If your business has an EMR greater than 1.0 the reason is simple. There has been a worker compensation claim that your insurance provider has paid. To mitigate the insurance company’s risk, your worker compensation premium is raised. The bad news is this increased EMR sticks with you for 3 years.

The base premium is calculated by dividing a company’s payroll in a given job classification by 100, and then by a ‘class rate’ determined by the National Council on Compensation Insurance (NCCI) that reflects the inherent risk in that job classification. For example, structural ironworkers have an inherently higher risk of injury than receptionists, so their class rate is significantly higher. A comparison is made of past claims history to those of similar companies in your industry. If you’ve had a higher-than-normal rate of injuries in the past, it is reasonable to assume that your rate will continue to be higher in the future. Insurers examine your history for the three full years ending one year before your current policy expires.

NCCI has developed a complicated formula that considers the ratio between expected losses in your industry and what your company actually incurred, as well as both the frequency of losses and the severity of those losses. A company with one big loss is going to be ‘penalized’ less severely than a company with many smaller losses, because having many small losses is seen as a sign that you’ll face larger ones in the future.

The result of that formula is your EMR, which is then multiplied against the manual premium rate to determine your actual premium (before any special discounts or credits from your insurer). Essentially, if your EMR is higher than 1.00, your premium will be higher than average; if it’s 0.99 or lower, your premium will be less.

How does a high EMR affect costs?

An EMR of 1.2 would mean that insurance premiums could be as high as 20% more than a company with an EMR of 1.0. That 20% difference must be passed on to clients in the form of increased bids for work. A company with a lower EMR has a competitive advantage because they pay less for insurance.

The good news is that EMR can be lowered. An effective safety program that eliminates hazards and prevents injuries is the starting point. No injuries equal no claims. In the real-world injuries will happen, but the response can help keep EMR from increasing as much as it could without proper management. Having a plan to manage injuries and workers compensation claims is a must to get control of the EMR.

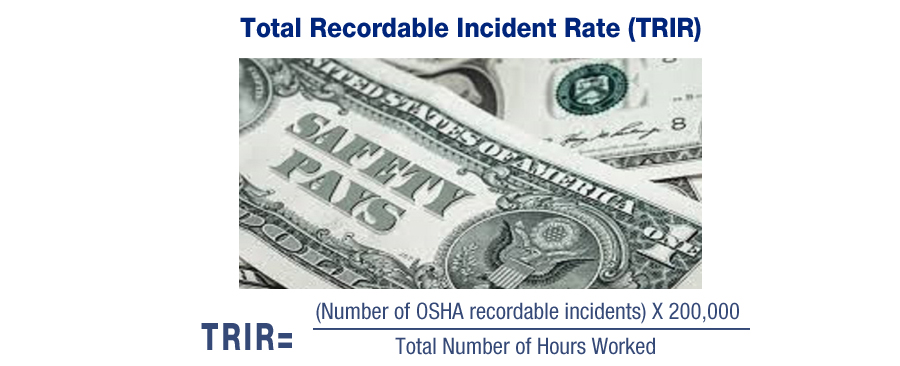

What is TRIR?

TRIR stands for "Total Recordable Incident Rate." It is a mathematical computation that takes into account how many OSHA recordable incidents your company has per number of hours worked and this number can determine your company's fate in ISNetworld. TRIR formula is stated above:

A perfect TRIR score is zero, which means that you had no OSHA recordable incidents. The higher your TRIR number the more likely that your company will lose points in ISNetworld and chances are your grade will suffer. Your clients in ISNetworld will compare your TRIR score against the industry average TRIR, for your line of work. If your TRIR gets too high, some companies won't let you work for them at all. Smaller companies should be very careful about recordable incidents.

For example:

Your company has 2 employees – yourself and a partner.Your partner cuts his finger on the job and gets 3 stitches. This is a recordable OSHA incident and required to go in your OSHA log. 1 OSHA recordable incident x 200,000 divided by 4160 total hours worked (2 full time people for a year) - your TRIR would be 48 – sky high compared to an oil industry average of 3 or 4. Even after 2 years your average would be 16 – far above the industry average. If you run a small company, it is extremely important to be very safety conscious. Even a single OSHA recordable incident can cause your TRIR to go well above the industry average and in extreme cases, cause your company to be banned from certain facilities!

Mike Ryan, Q.S.S.P, CSMP